Enjoy a select portfolio of over 8,000 trading instruments for 40,000+ investors from 110+ countries

A Guide to Financial Independence: How to Buy Stocks8-min read

Introduction to Stock Investments

Want to get started growing your wealth? Do you want to make money on the stock market but you don’t know where to start? Interested in creating a portfolio which will stand the test of time and let you retire early and safely? Then there’s no other time-proven alternative better than early investing and, when it comes to investing in India, purchasing stocks is still the most favoured choice that you would come across in your road to financial prosperity.

Want to get started growing your wealth? Do you want to make money on the stock market but you don’t know where to start? Interested in creating a portfolio which will stand the test of time and let you retire early and safely? Then there’s no other time-proven alternative better than early investing and, when it comes to investing in India, purchasing stocks is still the most favoured choice that you would come across in your road to financial prosperity.

Purchasing a company’s stock constitutes investing in the stock market. Towards this goal, you need to first speak to a stock exchange member or broker who is registered with SEBI if you want to purchase shares. Otherwise, you as an investor can also invest in a variety of other asset classes, including mutual funds, gold, and real estate in order to diversify your portfolio. This being said, historically, it has been demonstrated that stock trading platforms provide the best returns. This guide thus aims to explore the fundamentals of buying stocks in India by taking a succinct dive into the Indian stock market.

To learn more about investing in the stock market and achieving success as a trader and investor, read on for our comprehensive guide on how to buy stocks. The good news is that anyone, regardless of background or expertise, can start investing today.

Where to Buy Stocks in India – Best Stock Brokers for July 2024

Consider investing in stocks and securities if your objective is capital growth and maximising returns from the market. You have the best chance to build up your portfolio if you invest in shares for the long term since you can get returns of up to 16%, possibly even up to 20% quarterly. Even if you take a more conservative approach, compounding will have your wealth grow steadily throughout the years and turn your investments into your financial future.

However, you must first understand the fundamentals of the stock market before you begin trading on the stock market. This being said, many of you might have a common question in your mind about where your money should be invested in so as to get the best possible returns or whom should you trust as an ideal broker for buying stocks in India. The following Indian brokerages unanimously hold positive reviews as the most reliable and trustworthy brokers for new and experienced investors alike:

Pros

-

Over 40,000 active clients from 110+ countries, carrying out an average of 1.5 million trades per year.

Over 40,000 active clients from 110+ countries, carrying out an average of 1.5 million trades per year. -

Competitive spreads as low as 0.5 pips and up to 500:1 leverage for forex trading.

Competitive spreads as low as 0.5 pips and up to 500:1 leverage for forex trading. -

Provides access to over 8,000 trading instruments, including 40+ forex pairs, 200+ stocks, and 5+ cryptocurrencies.

Provides access to over 8,000 trading instruments, including 40+ forex pairs, 200+ stocks, and 5+ cryptocurrencies.

Cons

-

Admiral Markets has relatively high minimum deposit requirements for some account types, such as those in GBP.

Admiral Markets has relatively high minimum deposit requirements for some account types, such as those in GBP. -

Some users have reported slow response times from customer support, during excessively busy periods.

Some users have reported slow response times from customer support, during excessively busy periods.

Pros

-

0% fees on stock trades, minimum deposit of only $10 or equivalent

0% fees on stock trades, minimum deposit of only $10 or equivalent -

Over 322 tradable assets available

Over 322 tradable assets available -

Unmatched user-friendly interface, easy for beginners to catch on

Unmatched user-friendly interface, easy for beginners to catch on

Cons

-

Unavailable in some countries, including the United States

Unavailable in some countries, including the United States -

Only features two types of accounts (Demo and Standard)

Only features two types of accounts (Demo and Standard)

Individual traders and investors can invest in several markets using leading stock brokers in the Indian market like Libertex, Admiral Markets and Saxobank which serve as top-notch platforms for a reasonable price. Due to their user-friendly design and generally lower commission rates than their rivals, such online brokers provide a wonderful customer experience. Reduced commission rates, the absence of custody costs (if Securities Lending is chosen), free commission credits, and free live pricing on SG, US, and other exchanges are also advantages. Customers who frequently engage in international trade will find this especially helpful because it is both reasonably inexpensive for them to do so and provides them with the most recent information.

Admiral Markets is an international forex and CFD broker with a strong reputation in the industry. The broker offers a wide range of trading instruments, including stocks, forex, commodities, cryptocurrencies, and more. For stock traders, Admiral Markets offers access to more than 4,000 stocks from 15 of the world’s largest stock exchanges, including the NYSE, NASDAQ, LSE, and more.

Admiral Markets is an international forex and CFD broker with a strong reputation in the industry. The broker offers a wide range of trading instruments, including stocks, forex, commodities, cryptocurrencies, and more. For stock traders, Admiral Markets offers access to more than 4,000 stocks from 15 of the world’s largest stock exchanges, including the NYSE, NASDAQ, LSE, and more.

In addition to its extensive range of trading instruments, Admiral Markets offers competitive trading conditions for traders, including spreads as low as 0.5 pips, leverage of up to 500:1, and no commission on stock trading. The broker also offers excellent customer support and easy deposit and withdrawal options, making it a great choice for both novice and experienced traders alike. Overall, Admiral Markets is a reliable and trustworthy broker for those looking to trade stocks and other financial instruments in India and abroad.

What Are Stocks and Why Should They Be in Your Portfolio

Buying stocks is not a new concept, especially in India, and has been practised for quite some time now. However, for some of you who are not quite accustomed to buying stocks, a stock is a share that entitles the owner to a fixed payout, whose payment is prioritised over dividends on regular shares. One of the key benefits of investing in the stock market is the potential to improve one’s income. If the stock market gains value over time, the value of a particular stock may rise or fall over time. When an investor uses sound judgement, their chances of making a return from their investments are increased. The stock market is, after all, incredibly volatile. This being said, there are a number of key advantages to investing in stocks over other types of investments.

To fully comprehend the peculiarities of the history of the global public finance system and that of the closely related private (international) banking and finance system, it is necessary to view them in the context of the general history of the Netherlands and its institutions, as well as the general economic history of the Netherlands and of other mercantile European states who sought to diversify risk by allowing retail investors provide money for dangerous over-seas trade missions.

This history, which focuses on the fiscal and financial sectors, is sectoral as opposed to general history. The first joint-stock company to get a fixed capital allotment was the Dutch East India Company (established in 1602), which led to enduring trading in company shares on the Amsterdam Exchange. It was 1875 when India formed its first stock exchange, the BSE (Bombay Stock Exchange). A recurrent version, NSE (National Stock Exchange) was formed much later in 1992 and since then, both these exchanges have been lively functioning in the country.

Inflation and Market Volatility

Whether novice investor or seasoned veteran of the trade, the stock market can be frightening. This being said, it’s also a powerful tool for accumulating money and, with the appropriate approach, you can eventually amass hundreds of thousands of rupees (or more). Making or maintaining wealth in the stock market is also not as difficult as it might appear. In actuality, using the power of compounding is the key to accumulating wealth and needs almost no effort on your part.

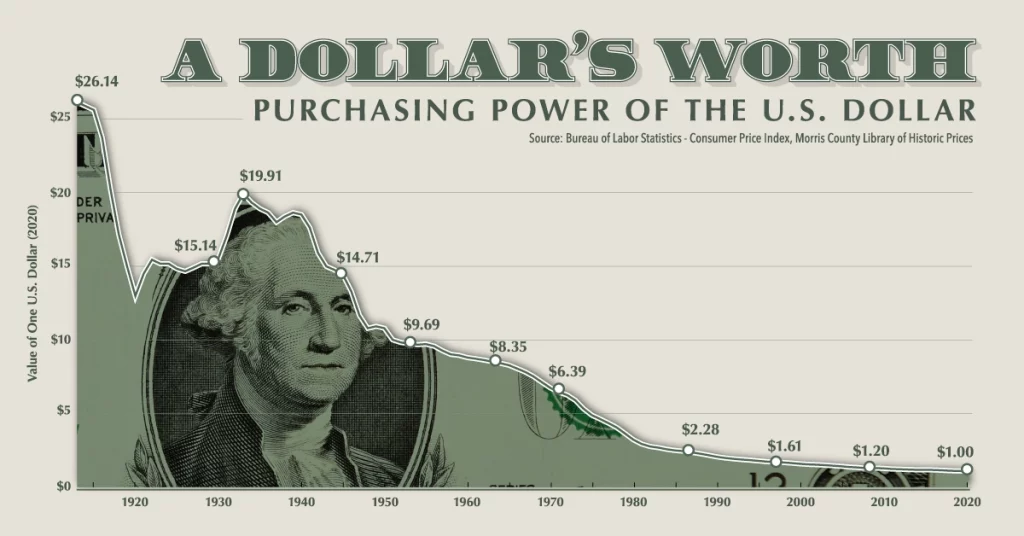

Source: The Visual Capitalist

Long-term inflation reduces the value of your wealth and income in terms of purchasing power. This implies that even if you invest and save money, the number of goods and services your money can buy will decrease over time. Additionally, individuals delaying investing and conserving will suffer even more.

Although there is no denying the effects of inflation, there are strategies to combat them. You ought to hold at least a few investments with prospective returns higher than inflation. For instance, dollars make up about 60% of worldwide foreign exchange reserves, but their proportion has been steadily declining as technology and markets have developed, reducing the dollar’s dominance in international payments.

How to Buy Stocks in India

You must first speak with a member, or broker, of a stock exchange who is registered with SEBI if you want to purchase shares. In recent times though, such is facilitated through digital brokerage platforms. Before you start investing, you must first register as an investor by taking the following actions:

- Locate a Registered Member/Broker of SEBI

- Identify the stock exchange with which they are registered. The majority of brokers are members of both exchanges.

- Obtain your passport, Aadhar card, passbook, and other relevant documents

- Complete the KYC and Agreement forms, and request copies

- Open your DEMAT account

- Deposit the required amounts and start investing!

- That’s it. Simple isn’t it? Well here’s a simpler breakdown of the process

Step by Step Tutorial on Buying Stocks

Follow these five steps and start investing in stocks

1. Choose a web-based stock broker

The most straightforward method to buy stocks is through an online stockbroker. Following account creation and funding, you can immediately buy stocks on the broker’s website. There are also other options, such as buying shares directly from the company or using a full-service stockbroker.

2. Examine the stocks you want to purchase

The process of choosing stocks can begin once your brokerage account has been created and funded. Investigating businesses you are already familiar with from past customer interactions is an excellent way to start.

3. Choose how many shares to purchase

There should be no pressure placed on you to purchase a specific quantity of shares or to include any stock in your portfolio. To get your feet wet, think about beginning with paper trading utilising a stock market simulator. Paper trading allows you to practise buying and selling stocks using fake money. Or you can start small — really small — if you’re willing to invest actual money. You may invest in only one share to get a sense of what it’s like to hold individual equities and determine whether you have the stamina to endure the difficult times with little loss of sleep. This being said, a later section in this guide will show you that you may soon be able to automate the process rather than going though the hassle yourself.

4. Select the stock order type

Don’t let the overwhelming amount of numbers and bizarre word combinations on your broker’s online order page deter you. Go through this cheat sheet of the preliminary stock-trading terms given below.

5. Make your stock portfolio more effective

In case the market conditions get challenging, always remember that every investor experiences challenging times, including Warren Buffett. Keeping a fixated perspective and focusing on the aspects that you can control, can help you succeed in the long run.

We have shortlisted the most reliable brokers for investing in the best Indian stocks, which have been vetted over a period of six months or more from multiple accounts, to ensure full compliance with legal requirements, as well as to test them on payment processing, security, as well as deposit and withdrawal requirements. We have also looked at the effectiveness of their Customer Support team.

Investing in the Best Indian Stocks

Choosing the right Indian stocks to invest in can be a daunting task for investors. However, with careful research and analysis, investors can identify top-performing companies that offer growth potential and long-term value. Some of the best Indian stocks to consider for investment include Tata Consultancy Services (TCS), HDFC Bank, and Infosys.

Tata Consultancy Services is a leading information technology (IT) services company that provides consulting, software development, and other IT-related services to clients around the world. HDFC Bank is a private sector bank that has consistently delivered strong financial performance and is known for its robust risk management practices. Infosys is another IT services company that has a strong track record of innovation and has been investing heavily in emerging technologies like artificial intelligence and automation.

Investors should consider a range of factors when evaluating Indian stocks, including the company’s financial performance, market position, management quality, and growth prospects. It is also important to consider external factors like government policies, global economic trends, and industry-specific factors. By staying informed and conducting thorough research and analysis, investors can identify top-performing Indian stocks that offer growth potential and long-term value, thus making the most lucrative and safest decisions when deciding to invest at home, in the best Indian stocks.

How to Buy Cheap Indian Stocks

Investing in penny stocks can be an attractive option for those looking to invest in the Indian stock market with limited upfront funds. Penny stocks are low-priced stocks that may be undervalued and have the potential for high returns on a smaller investment.

It is important to keep in mind, however, that penny stocks carry a higher level of risk than other types of stocks due to their volatility. Investors should conduct thorough research and analysis before investing in penny stocks and should be prepared for the possibility of significant losses. It is recommended that investors consult with a financial advisor or investment professional to gain a better understanding of the risks and potential rewards of penny stock investing.

It is important to keep in mind, however, that penny stocks carry a higher level of risk than other types of stocks due to their volatility. Investors should conduct thorough research and analysis before investing in penny stocks and should be prepared for the possibility of significant losses. It is recommended that investors consult with a financial advisor or investment professional to gain a better understanding of the risks and potential rewards of penny stock investing.

It is also important for investors to carefully consider their investment goals and risk tolerance before investing in penny stocks. Penny stock investing may not be suitable for all investors, and it’s important to have a well-diversified investment portfolio to minimise risk. By doing thorough research and analysis and seeking guidance from investment professionals, investors can make informed investment decisions and potentially reap the benefits of investing in the best cheap Indian stocks.

Choosing the Right Stock Exchange for You

Great! Now you’ve decided to start investing at last. You already know that a company with a large amount of cash on hand is superior to one that is heavily indebted, that a low P/E ratio is typically better than a high P/E ratio, and that analyst recommendations should never be taken at face value. Here’s another pro tip for you from one of our wisest investors:

“A portfolio should be diversified over a number of industries. Whether or not you’ve navigated the technical analysis’s more challenging ideas, that pretty much covers the fundamentals. It’s time for you to choose stocks.”

But hold on! How can you pick only a few stocks out of the tens of thousands of options available? Regardless of what some industry experts may claim, it is simply not possible to scrutinise every balance sheet to find businesses that have a good net debt position and are increasing their net margins. Therefore, you should:

- Establish your goals for your portfolio and stick to them.

- Choose a sector that appeals to you, and learn about the news and trends that shape it every day.

- Focus on the figures and the institution or institutions that are leading the sector.

- Be aware that stock picking underperforms passive indexing frequently, particularly over longer time horizons.

Vetting Our Recommended Brokers

At CoinBharat, we rigorously check the brokers which we recommend, by opening accounts ourselves with them, testing them on withdrawal times and requirements, reviewing their investment portfolio, the variety of payment requirements that they accept and closely inspecting their terms and conditions to ensure that they abide by legal requirements and that users can safely open accounts without any issues. We also take feedback from the community and that we verify every claim or complaint before recommending a broker. For more information about our vetting process, click here.

The Art of Choosing the Right Stock

Stock values are impacted daily by market forces. According to this, share prices are influenced by supply and demand. If there are more buyers than sellers of a stock, the price of that stock will increase. On the other side, a stock’s price would decrease if there was a greater supply than there was a demand for it. Economic activity can have a positive or negative impact on market patterns. Government actions and geopolitical happenings can influence the stability or instability of the market. Other vital entities include the natural equilibrium between supply and demand and market participant expectations.

Defensive Stocks

When the economy is struggling, the markets are volatile, or a particular industry is experiencing a slump, defensive stocks are able to sustain their share prices, earnings, and competitive advantages. Defensive stocks don’t experience “boom and bust” as often as cyclical ones do. Examples include commodities, real estate companies or other very safe but slow-growing assets.

Offensive Stocks

Contrarily, with an offensive or aggressive stock, a buyer looks to profit from a rising market by investing in assets that are outperforming at particular risk and volatility levels. Options trading and margin trading may also be included in an offensive strategy.

However, it is a must that you should subtly buy stocks after reviewing the related risks because projections are very promising, especially in the long term and that one can still become very rich by investing at the right time. Examples include stocks in start-ups or tech which are riskier but can grow extremely quickly. Think about Amazon or Google in the early 2000’s and you can see what we mean.

Indian Energy Stocks

Indian energy stocks offer investors the opportunity to tap into a growing sector that is vital to the country’s economic development. The energy sector in India has been growing rapidly in recent years, driven by factors such as urbanization, industrialization, and increasing demand for electricity. India is one of the world’s fastest-growing energy markets and is expected to become the world’s largest energy consumer by 2030.

When it comes to investing in Indian energy stocks, there are a number of options available. Some of the top energy stocks in India include Reliance Industries, Oil and Natural Gas Corporation (ONGC), and Bharat Petroleum Corporation Ltd. (BPCL). Reliance Industries is a conglomerate with interests in energy, petrochemicals, and telecommunications. ONGC is a state-owned oil and gas company and one of the largest energy exploration and production companies in India. BPCL is a government-owned oil and gas company that operates refineries and marketing networks across India.

Investing in the best energy stocks in India can provide investors with exposure to a sector that is essential to the country’s growth and development. However, as with any investment, it is important to conduct thorough research and analysis before making any investment decisions. Factors such as global oil prices, government policies, and technological advancements can all have an impact on the performance of energy stocks. By staying informed and making informed investment decisions, investors can tap into the potential of the Indian energy sector.

Best Renewable Energy Stocks in India

Renewable energy stocks in India are gaining traction as the country moves towards clean energy solutions. The Indian government has set ambitious targets for renewable energy, aiming to generate 450 GW by 2030. This target includes 175 GW of renewable energy from sources like solar, wind, and hydro power. With increasing government support and investment in the sector, renewable energy stocks are poised for growth.

Some of the top renewable energy stocks in India include Adani Green Energy, Tata Power, and Bharat Heavy Electricals Limited (BHEL). Adani Green Energy is a leading player in the renewable energy space, with a focus on solar power projects. Tata Power is another well-known name in the sector, with a significant presence in solar and wind energy. BHEL is a government-owned company that specializes in power generation equipment and has been investing in renewable energy projects.

Investing in renewable energy stocks in India can provide an opportunity for growth, while also contributing to the country’s efforts towards a sustainable future. As with any investment, it is important to conduct thorough research and analysis before making any decisions about investing in the best renewable energy stocks in India.

Taxation on Stock Earnings

Long-term capital gains are taxed at a higher rate than short-term capital gains. Short-term capital gains that are subject to Section 111A of the Income Tax Act are subject to a 15% tax. This comprises securities that were sold on or after October 1, 2004, on a recognised stock exchange, and that are subject to the securities transaction tax, such as equity-oriented mutual funds, equity shares and units of business trust (STT). For more detailed information, please visit here.

Investing Responsibly

Buying stocks is subjected to varying market risks, please read detailed information and acknowledge best practices before investing. Never spend more than you can afford to lose. Remember that the market is extremely volatile and that you should always perform your own research. It is also advised to keep track of the bankroll in order to decide when to withdraw.

Latest Updates

India’s economy is set to expand by 5.9% in 2023, according to the International Monetary Fund (IMF). Although the IMF lowered its forecasts for India’s full-year growth, the country is still expected to be a major contributor to the Asia-Pacific region’s growth. The IMF also raised its growth outlook for China, Malaysia, the Philippines, and Laos. However, despite the overall optimism for the region, the IMF downgraded its predictions for Japan, Australia, New Zealand, Singapore, and South Korea, with domestic factors and external demand from China being a major concern.

Conclusion

Well, we’ve come to an end. In case you’ve missed out, here’s a rundown of all that’s been discussed:

- Individual traders and investors can invest in several markets using leading stock brokers in the Indian market like Libertex, Admiral Markets, and Saxobank which serve as a top-notch platform for a reasonable price.

- Market stability or instability can be caused by variables such as government policies, market participant expectations and geopolitical developments.

- Making or maintaining wealth in the stock market by using the power of compounding is the key to accumulating wealth and needs almost no effort on your part.

The stock market has experienced a significant drop due to concerns about an economic downturn, and it could worsen soon. During times of general financial anxiety, there are often chances to buy stocks at lower prices. It is important for investors to remain calm and consider the long-term prospects, even when the financial climate appears to be in disarray.

There you have it. A detailed guide to starting your stock investment journey today. A final piece of advice from our side: “Start small, remain consistent, learn and analyse the market in-depth, and you shall too begin generating profits”.

FAQs

How to buy stocks in India?

It can be bought through various stock exchanges/brokers operating in India.

Where to buy stocks in India?

It can be bought through a SEBI-registered member, or broker, of a stock exchange.

What are the best exchanges to buy stocks from?

Libertex, Admiral Markets, and Saxobank are some of the best exchanges/brokers to buy stocks.

Are stocks safe?

Stocks market is volatile so invest at your own risk

Do stocks protect me from inflation?

Stocks are a good alternative to hedge against both short and long-term inflation.

What are the signs of a responsible and reputable broker?

Look for commissions, credibility, account fees, tools offered, etc.