Profit at a Discount: Best Cheap Indian Stocks12-min read

The Best Cheap Indian Stocks for Low-Risk/High-Reward Trading

The Indian stock market is a blossoming ground for many investors who have made a significant amount of money by trading and holding the Southeast Asian country’s stocks. It is crucial to note that some of the biggest and highest-priced stocks in the Indian stock market have achieved tremendous success in the last decade or two.

Interestingly, higher-priced stocks are often the centre of attention of the market and therefore, subject to more regulations. Meanwhile, they are also less risky and provide gains over a longer period of time since they have a reputation to follow. On the other hand, the best cheap stocks to buy in India are often under-rated or hidden from the general public’s eyes and as a result, perform better in a shorter run.

Interestingly, higher-priced stocks are often the centre of attention of the market and therefore, subject to more regulations. Meanwhile, they are also less risky and provide gains over a longer period of time since they have a reputation to follow. On the other hand, the best cheap stocks to buy in India are often under-rated or hidden from the general public’s eyes and as a result, perform better in a shorter run.

Lower-priced stocks might give good results in a shorter run but are subject to lesser regulatory scrutiny and therefore, involve more risks. It is clear in the case of these stocks that affordability comes at the cost of volatility and risks. It is advised to invest cautiously in lower-price stocks since there is also a fair chance of losing money.

The Indian stock market is worth more than $3 trillion and identifying cheap stocks can be a daunting task. All the stocks that are less than $5 can be considered as cheap while those lesser than $1 are termed as penny stocks. Investors in stock markets are regularly watching out for penny stocks to add to their existing portfolio.

In this article, we will discuss some of the best cheap stocks to buy in India that have the long-term capabilities of generating great returns and are providing some value to the economy. Newbie investors usually look at these cheaper stocks because one can purchase more stocks at a certain budget while to obtain the same number of higher-priced stocks, the budget needs to be raised.

In This Guide:

- Key Factors to Consider When Choosing a Broker for Affordable Indian Stocks

- Top Broker Options for Affordable Indian Stocks

- Factors to Consider When Choosing Cheap Stocks

- Best Cheap Stocks to Buy in India

- Tutorial: How to Invest in Cheap Indian Stocks Online

- Tips for Investing in Cheap Stocks

- Harnessing the Power of Dividend Stocks for Lasting Financial Growth

- Conclusion

Pros

-

Swift Account Setup: Account activation in approximately 5 minutes with an efficient digital process.

Swift Account Setup: Account activation in approximately 5 minutes with an efficient digital process. -

Robust Support & Education: 24-hour multilingual support and comprehensive educational resources through AvaTrade Academy.

Robust Support & Education: 24-hour multilingual support and comprehensive educational resources through AvaTrade Academy. -

Diverse Investment Products: Over 1,260 tradeable symbols, including Forex and cryptocurrency CFDs.

Diverse Investment Products: Over 1,260 tradeable symbols, including Forex and cryptocurrency CFDs.

Cons

-

Withdrawal Timeframe: Although competitive, withdrawals can take up to two business days.

Withdrawal Timeframe: Although competitive, withdrawals can take up to two business days. -

Mobile App Features: While AvaTrade's mobile apps are innovative, they lack some advanced features compared to other industry leaders.

Mobile App Features: While AvaTrade's mobile apps are innovative, they lack some advanced features compared to other industry leaders.

Key Factors to Consider When Choosing a Broker for Affordable Indian Stocks

1. Regulatory Compliance and Reputation

Ensure the broker is registered with reputable regulatory bodies such as the Securities and Exchange Board of India (SEBI) or international regulators like the Cyprus Securities and Exchange Commission (CySEC). Regulatory oversight ensures your investments are secure and the broker adheres to strict operational standards.

2. Competitive Fee Structure

Investing in low-priced stocks often involves frequent trading; hence, high brokerage fees can erode returns over time. Look for brokers offering:

- Zero or Low Commission on Trades

- Transparent fee structures without hidden charges.

3. Access to Indian and Global Markets

A good broker should provide access to a diverse range of stocks from both Indian markets and global exchanges. This allows you to build a well-diversified portfolio.

4. Research and Educational Tools

Investing in affordable stocks requires thorough research. Look for brokers offering:

- In-depth research reports.

- Financial analysis tools.

- Educational resources such as webinars and tutorials.

5. User-Friendly Platform

Ease of use is critical for both beginners and seasoned investors. The trading platform should feature:

- Intuitive navigation.

- Advanced charting and analysis tools.

- Mobile accessibility for trading on the go.

6. Customer Support

Reliable customer service ensures prompt assistance with account issues, trading queries, or technical difficulties. Opt for brokers with 24/7 support via multiple channels, including chat, email, and phone.

Top Broker Options for Affordable Indian Stocks

AvaTrade

Overview:

AvaTrade is a globally trusted broker offering a wide range of financial instruments, including Indian stocks. Known for its user-friendly interface and robust educational resources, AvaTrade is ideal for both beginners and experienced investors.

Key Features:

- Zero Commission on Stock CFDs: No fees on trades, helping investors maximize returns.

- Advanced Trading Platforms: Access to MetaTrader 4, MetaTrader 5, and AvaTrade’s proprietary WebTrader.

- Comprehensive Educational Resources: Tutorials, webinars, and market analysis reports tailored for investors.

- Regulated by Multiple Authorities: Including CySEC and the Central Bank of Ireland.

Why Choose AvaTrade?

AvaTrade’s zero-commission structure and access to a wide range of stocks make it a cost-effective choice for investors. Additionally, its platform supports advanced tools for analyzing stock performance, empowering investors to make informed decisions.

Zerodha

Overview:

India’s leading discount broker, Zerodha, offers a cost-effective solution for stock investors, with its innovative trading platform, Kite.

Key Features:

- Low Brokerage Fees: Minimal costs for equity investments.

- Comprehensive Tools: Advanced charting features and seamless fund management.

- Regulated by SEBI: Ensures investor protection and operational transparency.

Why Choose Zerodha?

Zerodha’s low-cost structure and powerful analytical tools make it an excellent choice for investors focused on domestic stocks.

ICICI Direct

Overview:

A full-service broker providing access to Indian and international markets, ICICI Direct is well-suited for investors seeking comprehensive services.

Key Features:

- Integrated Banking and Trading Services: Allows seamless fund transfers.

- Expert Research: Access to detailed reports on stocks.

- Strong Customer Support: Ensures assistance at every stage of your investment journey.

Why Choose ICICI Direct?

ICICI Direct offers in-depth research and personalized advisory services, making it ideal for investors who prefer a guided approach.

Factors to Consider When Choosing Cheap Stocks

Before choosing a platform and investing in cheaper stocks, it is very important for investors to do thorough research. As explained above, penny stocks pose a greater risk to investors and while providing greater returns, they can deal greater losses to investors as well.

Before choosing a platform and investing in cheaper stocks, it is very important for investors to do thorough research. As explained above, penny stocks pose a greater risk to investors and while providing greater returns, they can deal greater losses to investors as well.

According to our research, there are many indications and financial details that investors should consider before putting their money in penny stocks:

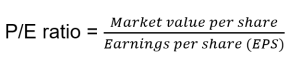

Price-to-earnings ratio:

The price-to-earnings ratio or P/E ratio is the ratio of share price of a stock to its earnings per share (EPS) and is one of the most popular metrics to define the profitability of the company that you are interested in investing in and can be used to compare the company’s past, present, and projected performance. Therefore, P/E ratio can be calculated on the basis of trailing (backward-looking) or forward (projected) basis.

A higher P/E ratio confirms that the company is overvalued or that investors are expecting high growth rates in the future. A company that is not making any profit has no P/E ratio.

The formula for P/E ratio is simple:

P/E ratio =

So, to calculate the ratio, simply divide the current stock price by EPS. However, this results in two types of P/E ratios, i.e., forward and trailing twelve months (TTE) P/E ratios.

The TTE P/E ratio is calculated by dividing the current share price by the last 4 quarterly EPS which are mentioned in the financial results of a company every quarter. Meanwhile, the Forward P/E ratio is calculated dividing the share price by the projected EPS over the next 4 quarters, contained in the company’s annual filings.

Debt-to-equity ratio:

The debt-to-equity ratio, commonly called D/E ratio, is very crucial for measuring a company’s financial leverage and is calculated by dividing its total liabilities by its shareholders. D/E ratio is a specific type of gearing ratio that determines how much debt a company is using to fund operations rather than to use its own resources.

D/E ratios differ by industry and are most useful for comparing a company to its direct competitors or tracking variations in its dependence on debt over time. A higher D/E ratio among companies of a similar size indicates greater risk, whereas an exceptionally low one might suggest that a company is not using debt financing for expansion.

This important metric in corporate finance is simply calculated as:

D/E ratio =

The information required to calculate D/E ratio can be found on the company’s balance sheet. The amount of shareholder equity is calculated by subtracting the value of liabilities from the value of total assets on the balance sheet, which is a rearranged representation of the following equation:

Assets = Liabilities + Shareholder Equity

Notably, investors usually modify the D/E ratio to take only long-term debt into account as it carries more risk than short-term obligations.

Dividend yield:

The dividend yield, displayed as a percentage, displays how much a company pays to its shareholders each year for owning a share of its stock dividend relative to its current stock price. This is a financial ratio that estimates the dividend-only return of a stock investment.

The dividend yields for companies in the consumer products and utility industries tend to be higher than others. However, it is important for investors to understand that higher dividend yields do not always suggest rewarding investment opportunities as the dividend yield of a stock may be elevated due to a declining stock price.

Here is the formula for dividend yield:

The dividend yield is commonly calculated from the company’s last year’s financial report. This is valid in the initial months after the company releases its annual report, but the more time has passed since the release of the annual report, the less useful this information is to investors.

Alternatively, investors can also choose to add the last four quarters’ dividends, which will include the trailing 12 months’ dividend data. Though one can use the trailing dividend number, it can make the yield excessively high or low if the dividend has recently been changed.

Shareholding Pattern:

The shareholding pattern provides insight into how a company’s shares are allocated among different entities. These provide investors with information about the financial health of a company. It provides investors with information about a company’s financial health and refers to its stock’s shareholding percentage across different classes of investors.

Since shareholding patterns reflect a company’s share ownership structure, investors should check this factor before buying any stock. For instance, promoters, which have a huge influence on a company, may hold senior executive positions and have a major controlling stake in it.

Volatility

Volatility, a statistical measure of the dispersion of returns for a given asset, represents how large its prices swing around the mean price. It often refers to the degree of risk or uncertainty associated with the size of changes in a stock’s value.

Generally, volatile stocks are considered riskier than less volatile ones because the former’s price is expected to be less predictable while the latter tends to be more steady.

Volatility is often measured using either the variance or standard deviation (square root of the variance) between returns from that same stock. Since volatility describes fluctuations over a particular time period, the standard deviation is simply multiplied by the square root of the same number of periods.

Volatility (v) = σ√T

where v, σ, and T represent volatility over some time interval, standard deviation of returns, and number of periods in the time horizon, respectively.

Best Cheap Stocks to Buy in India

YES Bank (YESBANK)

YES Bank is one of the leading banking companies in India which lost the confidence of its customers a few years ago as it was unable to raise money which led to potential loan losses and as a result, investors invoked bond covenants, which was followed bya withdrawal of deposits by customers.

However, a historic Yes Bank Reconstruction Scheme 2020 initiated by other major banks in India was created and investors’ confidence in the bank was reinstated. Rana Kapoor, co-founder and previous CEO of the bank was fired as a result, and he was arrested in connection with a INR 466 crore money laundering case.

On the other hand, YES Bank is now a subsidiary of the State Bank of India (SBI) which has a 30% stake in the banking institution. On 21 February 2023, Yes Bank issued 2,13,650 equity shares to its employees under the company ESOP plan.

The price of the YESBANK share is currently INR 15 ($0.18) and is one of the best penny stocks with potential to perform better in the future under SBI. The bank posted a revenue of INR 22,423 crore ($2.8 billion) in 2022.

Bank of Maharashtra (MAHABANK)

The Bank of Maharashtra (MAHABANK) stock is currently valued at INR 25 ($0.30). It is a central public sector bank under the ownership of the Ministry of Finance, Government of India. As of March 2022, the bank had 29 million customers and also has the largest network of branches of any central public sector undertakings in the state of Maharashtra.

The Bank of Maharashtra (MAHABANK) stock is currently valued at INR 25 ($0.30). It is a central public sector bank under the ownership of the Ministry of Finance, Government of India. As of March 2022, the bank had 29 million customers and also has the largest network of branches of any central public sector undertakings in the state of Maharashtra.

The bank posted a revenue of INR 13,144.67 crore ($1.6 billion) in 2020 while the revenue in 2022 stood around INR 775 crore ($93 million) which was up 138.76% from 2021. Despite the drop in revenue as compared to 2020, the banking institution has performed better in 2022 and investors can expect better performance from the penny stock in the coming days.

Central Bank of India (CENTRALBK)

The Central Bank of India is a popular public sector bank based in Mumbai but despite its name, it is not the central bank of the country. The actual central bank is the Reserve Bank of India. With clever wordplay, the banking institution was established on 21 December 1911 and is the first commercial Indian bank completely owned and managed by Indians.

The bank has been around for more than a hundred years and has survived two world wars and shares a strong history with India. The price of the CENTRALBK stock, which is one of the best cheap stocks to buy in India, is around INR 24 ($0.29) and was priced above INR $120 a few years ago. It is clear that the stock has potential.

On its 108th Foundation Day, the Central Bank of India launched its first step towards robotic banking, a robot named “MEDHA” and is one of twelve public sector banks in India that was recapitalised in 2009.

A revenue of INR 25,897.44 crore ($3.2 billion) was posted by the Central Bank of India in 2021 and the bank’s net profit for the quarter ending December 2022 increased by 64% to Rs 458 crore ($54.96 million) year-on-year, making it one of the best cheap stocks to buy in India today.

NHPC

NHPC, previously known as the National Hydroelectric Power Corporation, is an Indian government hydropower board under the ownership of the Ministry of Power, Government of India that was incorporated in the year 1975. Currently, NHPC is a Mini Ratna Category-I Enterprise of the Govt. of India with an authorized share capital of ₹150,000 Million ($18,17,289).

The company was listed publicly in 2009 and India and State Governments have 74.51% share as its promoter while the rest 25.49% is public shareholding. According to official filings, the revenue posted by NHPC in 2021 was INR 9,648 crore ($1.2 billion) while in 2022, the company posted a 12.59% decline in its consolidated net profit to INR 775.99 crore ($93 million) for the December 2022 quarter, mainly due to higher expenses.

Since NHPC is a government-owned company and a huge shift in hydroelectric sources of energy has been witnessed recently, it is certainly possible to witness promising performance from the NHPC stock and is therefore, one of the best penny stocks. The current price of the stock is INR 41.80 ($0.5) which is significantly up from the price of INR 15.10 in March 2020.

Indian Railway Finance Corporation (IRFC)

The Indian Railway Finance Corporation (IRFC) is an India-based financing arm of the Indian Railways and operates through the Leasing and Finance segment. The Government of India owns a majority stake in the company, while the Ministry of Railways has the administrative control.

The current price of one of the best penny stocks, IRFC, is around INR 27 ($0.33) and the company posted a revenue of INR 13,823.45 crore ($1.7 billion) in 2020, Interestingly, the net profit increased by 2.48% YoY to INR 1633.45 crore ($206 million) in the quarter that ended in December 2022 from INR 1593.91 crore ($201 million) in the quarter that ended in December 2021.

Tutorial: How to Invest in Cheap Indian Stocks Online

Investing in affordable Indian stocks has never been easier, thanks to platforms like AvaTrade. With its user-friendly interface and a wide range of trading tools, AvaTrade provides a seamless experience for both beginners and seasoned investors. Follow this step-by-step guide to start your journey with AvaTrade:

Step 1: Register on the AvaTrade Platform

- Visit the AvaTrade Website:

Navigate to the official AvaTrade site and click on the “Register” or “Sign Up” button. - Enter Your Details:

- Provide your email address or mobile number.

- Create a secure password.

If you’re new to AvaTrade, you’ll need to complete a simple registration process.

- Complete the Registration Form:

- Fill in your full name.

- Enter your country of residence and contact details.

- Provide other personal details such as your date of birth.

Step 2: Confirm Your Account

- Verify Your Email:

After submitting the registration form, AvaTrade will send a verification link to your registered email address. Open your email and click the link to confirm your account. - Mobile Verification (Optional):

Depending on your location, AvaTrade may send a verification code to your mobile number. Enter the code on the website to complete this step.

Step 3: Activate Your Wallet

- Set Up Your Trading Profile:

- Select your client type (e.g., individual or corporate).

- Choose the country of residence for your trading account.

- Provide Additional Details:

AvaTrade requires some basic financial information to comply with regulatory standards:- Employment Status

- Annual Income

- Trading Experience

- Submit Identification Documents:

Upload your Aadhaar card, PAN card, or any other government-issued ID for identity verification. You’ll also need to provide proof of address, such as a recent utility bill or bank statement.

Step 4: Fund Your Account

Once your account is verified, it’s time to activate your wallet by depositing funds. AvaTrade offers multiple payment options:

- Bank Transfers

- Credit/Debit Cards

- E-wallets (like Skrill or Neteller)

Minimum deposit requirements are low, making AvaTrade accessible for investors of all levels.

Step 5: Start Trading Cheap Indian Stocks

With your account set up and funded, you can now explore AvaTrade’s platform. Use its intuitive interface to:

- Search for Affordable Indian Stocks: Find stocks with growth potential at lower price points.

- Place Orders: Choose from various order types like market, limit, or stop-loss orders.

- Analyse Stock Performance: Leverage AvaTrade’s advanced charting tools and market indicators.

Step 6: Monitor and Optimise Your Portfolio

AvaTrade’s platform allows you to track your investments in real-time. Use the educational resources, including tutorials and webinars, to refine your strategy and stay updated on market trends.

Tips for Investing in Cheap Stocks

As some of the best cheap stocks to buy in India are highly volatile with low liquidity, they come with higher risks and inherently speculative nature. For instance, they are subject to the manipulation by the stock promoters and many trap you in pump and dump schemes.

Moreover, investors often get tempted by the illusion of easy exponential growth from value traps, which are stocks that look enticingly cheap but are actually poor investments.

Therefore, it is necessary for investors to conduct thorough research before investing in cheap stocks. Here are some of tips for making actual profits with cheap stocks without subjecting oneself in such risky situations:

- Diversify your portfolio: Investment diversification is crucial because the risk/reward ratio of all the best penny stocks can be considerably higher than that of large-cap stocks.

- Set stop-loss orders: In cases of extreme volatility, a stop-loss helps investors limit their loss on a stock position.

- Avoid emotional investing: When a stock makes an unfavourable move, investors should acknowledge and understand emotional investment psychology and avoid taking impulsive decisions.

- Buy companies with strong balance sheets: As many of cheap stocks are still in the early stages of development, investors should invest in companies with strong balance sheets and 50% or lower long-term debt (LTD) of shareholder equity. Such companies provide the best cheap stocks to buy in India today.

Harnessing the Power of Dividend Stocks for Lasting Financial Growth

The best dividend stocks in India provide investors with a reliable source of income by paying out a portion of a company’s earnings periodically. These stocks form a vital element in any well-balanced investment portfolio, ensuring that investors enjoy a combination of growth and regular income.

The best dividend stocks in India provide investors with a reliable source of income by paying out a portion of a company’s earnings periodically. These stocks form a vital element in any well-balanced investment portfolio, ensuring that investors enjoy a combination of growth and regular income.

The allure of high-yield dividend stocks lies in their capacity to contribute to long-term wealth accumulation while also generating a steady flow of passive income. This dual benefit helps protect investors from market fluctuations and offers the flexibility to reinvest or utilize the returns as desired. To make informed decisions, investors should assess dividend stocks based on key factors such as the dividend yield, payout ratio, and the company’s history of dividend payments, financial robustness, and growth prospects. By prudently selecting and incorporating dividend stocks into their investment strategy, investors can achieve greater diversification and long-term financial stability.

Whilst penny stock companies offering dividends are scarce, some start-ups are incentivised to offer attractive dividend packages to attract series A investors. If successful, these could pay out significant returns in the long-term, in some cases even providing sufficient passive income to retire on.

Conclusion

The best penny stocks present lucrative opportunities that are missed by the majority of players in the stock market due to decreased appetite for risk or shorter attention span. However, penny stocks perform well in the longer run if investors take care of fundamentals and do not trade emotionally but use their mind.

Trading bots can also be used to trade best penny stocks but it is crucial to note that it takes time to set up such bots since they learn gradually. Moreover, investors are also advised to use trustworthy and easy-to-use platforms for their trading like Admiral Markets which have been built by experts and have been around for a number of years.

The volatility and low liquidity of the best penny stocks is a major reason why investors fear investing in them. However, some of the stocks listed in this article were of banking institutions or of government entities and as a result, the investors in such stocks have higher chances of protection against disastrous events.

FAQs

What are cheap stocks, and how are they different from expensive stocks?

The best penny stocks are more volatile and have lower liquidity as compared to expensive stocks.

How do I find the best Indian cheap stocks to invest in?

Investors can find many cheap Indian stocks to invest in via Admiral Markets, a leading crypto, stock, and forex trading platform.

What factors should I consider before investing in Indian cheap stocks?

Before looking into the best cheap stocks to buy in India today, you should always check their price-to-earnings ratio, debt-to-equity ratio, dividend yield, shareholding pattern, and volatility.

Can I make a significant profit by investing in Indian cheap stocks?

Investors have made huge gains by investing in cheap stocks because some of these stocks gain a wider audience and explode when they expand their businesses.

How much money should I invest in cheap Indian stocks?

It is advised that investors should always diversify their portfolio and not invest their entire net worth in cheap Indian stocks.

Are there any risks associated with investing in Indian cheap stocks?

Yes, there are several risks associated with investing in Indian cheap stocks like high volatility and value traps. Therefore, while investing in such stocks, investors should always diversify their portfolio, set stop-loss orders, and avoid emotional investing.

How often should I review my Indian cheap stock portfolio?

Cheap stocks have relatively higher volatility and investors are advised to regularly check the performance of the stock as well as the company.

Should I invest in Indian cheap stocks for the short-term or long-term?

Investors can use online brokerage platforms like AvaTrade to invest in cheap Indian stocks.

Are there any tax implications to consider when investing in Indian cheap stocks?

Indian investors are subjected to a 20% tax rate on profits gained from investing in the best penny stocks.