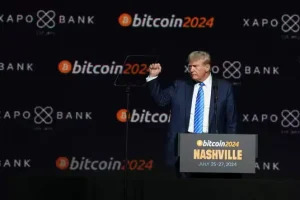

Crypto Markets Reflect on Post-Inauguration Trends as ‘Trump Coin’ Raises Eyebrows3-min read

In the aftermath of former President Donald Trump’s inauguration—which some investors anticipated might spark a wave of politically driven crypto speculation—many in the cryptocurrency community are taking stock of how digital assets fared. Although large-cap coins like Bitcoin (BTC) and Ethereum (ETH) did not see any seismic moves directly tied to the inauguration event, smaller niche tokens such as “Trump Coin” have generated curiosity and, for some, concern.

1. Mainstream Crypto Shows Resilience

Despite the often-volatile nature of crypto markets during major political events, established cryptocurrencies remained relatively steady:

- Bitcoin (BTC): BTC continued to trade within a moderate range, suggesting that traders, at least in the short term, did not interpret the inauguration as a strong directional catalyst.

- Ethereum (ETH): Ethereum’s price likewise held firm. Industry analysts attribute this stability more to ongoing DeFi and NFT developments than to political news.

Such resilience is in line with longer-term trends in the crypto space: while politics can create short-term ripples, major coins increasingly react to broader factors such as institutional adoption, macroeconomic data, and innovations in blockchain technology.

2. Enter ‘Trump Coin’: Meme or Something More?

So-called “Trump Coin” (not to be confused with other politically themed tokens like “MAGA Coin”) first appeared around 2016–2017 and has occasionally drawn renewed attention during pivotal political moments involving Donald Trump.

-

Origin & Branding:

- Unofficial Nature: According to multiple sources, Trump Coin is not officially affiliated with Donald Trump, his campaign, or the Trump Organization.

- Marketing Angle: Like many politically themed altcoins, the project leans heavily on slogans such as “Make Crypto Great Again,” aiming to tap into the enthusiasm of Trump supporters within the crypto community.

-

Market Activity:

- Volatility: In recent months, “Trump Coin” has exhibited sharp price fluctuations, often coinciding with any Trump-related headlines.

- Liquidity Concerns: Trading volume tends to be relatively low, and the token is listed on only a handful of smaller or decentralized exchanges.

-

Potential ‘Rug Pull’ Risk:

- Anonymous Team: A key red flag is that reliable information about the development team behind Trump Coin is scarce. Anonymous or pseudonymous teams are not automatically illegitimate in the crypto world (Bitcoin’s founder, Satoshi Nakamoto, was also pseudonymous), but for small tokens, lack of transparency often warrants caution.

- Contract Audit?: There is no widely publicized, reputable third-party audit of the Trump Coin smart contract. Unverified or unaudited code can contain hidden functions allowing the token’s creators to manipulate supply or liquidity—common precursors to so-called “rug pulls.”

- Community & Social Media Presence: The official Twitter-like channels and Telegram communities show some support, but critics point to abrupt spikes in promotional activity whenever Trump-related news trends, suggesting possible “pump and dump” cycles.

Given these points, many industry observers caution retail investors to thoroughly research any politically themed cryptocurrency—particularly when the branding appears to rely on a public figure who has no explicit endorsement or official involvement.

3. Opinions from Crypto Analysts

- Skeptical Stance: Analysts at Cointelegraph and CoinDesk argue that coins linking themselves to celebrities or politicians are often more “novelty” than substance, prone to price manipulation. They recommend verifying whether a project has an active and transparent development team, reputable partnerships, and a legitimate use case.

- Potential for Political NFTs: While many doubt the longevity of “Trump Coin,” some believe political tokens and NFTs could gain traction if they unlock real-world utilities—like access to exclusive events, membership benefits, or merchandise.

4. The Bigger Picture: Political Influence on Crypto

Even if Trump Coin itself remains on the fringe, the post-inauguration period highlights how political events can shape (or fail to shape) short-term sentiment:

- Regulatory Uncertainty: The evolving stance of U.S. regulators toward crypto—spanning from the Securities and Exchange Commission (SEC) to the Commodity Futures Trading Commission (CFTC)—often has a stronger, more lasting market impact than political figures do.

- Public Awareness: High-profile moments for any politician can drive new investors’ curiosity toward cryptocurrencies, for better or worse.

In this instance, the market response appears muted, indicating that the industry is focusing more on institutional developments and less on fleeting political headlines.

Conclusion

While the mainstream crypto market has barely flinched post-inauguration, politically branded tokens like “Trump Coin” have seen renewed chatter. However, given the lack of transparent development, an uncertain roadmap, and limited exchange listings, many experts warn that it carries significant “rug pull” risk. As always, investors should approach such niche projects with skepticism, verifying whether they offer any real utility beyond opportunistic branding.

Sources & References

- CoinDesk – CoinDesk News and Analysis

- Cointelegraph – Cointelegraph News and Analysis

- Etherscan – Contract and Token Tracking (useful for verifying whether a token’s smart contract has been audited or flagged)

- Official Trump Coin Website (Archived) – Historical snapshots exist on platforms like Archive.org if the official site is offline or changed.

- Crypto Twitter/Telegram Groups – Various discussion channels used by traders and community members to track Trump Coin and other politically themed tokens.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Always do your own research or consult a licensed financial advisor before investing in any cryptocurrency.